This occurs when the contra account is used to offset a credit balance in the related account. Of that amount, it is estimated that 1% of that amount will become bad debt at some point in the future. This means that the $85,000 balance is overstated compared to its real value. At this point, it isn’t known which accounts will become uncollectible so the Accounts Receivable balance isn’t adjusted.

What are some examples of contra accounts?

A company receives rebates for advertising it does on behalf of brands it carries in its stores. For example, a grocery store displays advertisements for a national brand in its weekly flyer. The national brand gives the grocery store cash, reducing the overall cost of printing the flyer. The purpose of the Allowance for Doubtful Accounts is to track the reduction in the value of the asset while preserving the historical value of the asset. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more.

What is a contra account?

Contra asset accounts are recorded with a credit balance that decreases the balance of an asset. A key example of contra liabilities includes discounts on notes or bonds payable. A regular asset account typically carries a debit balance, so a contra asset account carries a credit balance. Two common contra asset accounts include allowance for doubtful accounts and accumulated depreciation. Allowance for doubtful accounts represents the percentage of accounts receivable a company believes it cannot collect. Allowance for doubtful accounts offsets a company’s accounts receivable account.

What Is the Benefit of Using a Contra Account?

The offset to the Depreciation Expense account is Accumulated Depreciation. Sales are reported in the accounting period in which title to the merchandise was transferred from the seller to the buyer. Contra accounts are used to reduce the value of the original account directly to keep financial accounting records clean.

What is an example of a contra revenue account?

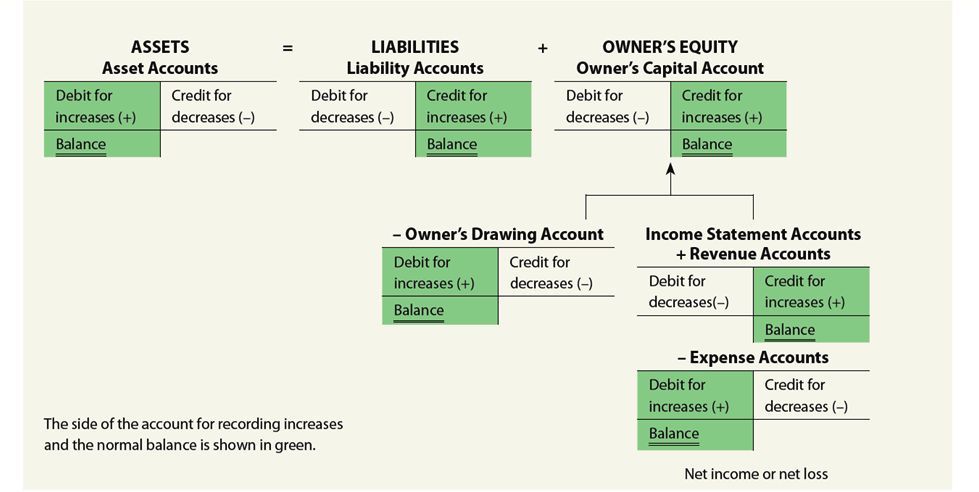

The points below explain the importance of passing a contra account entry. From studying the basics of debit and credit, balance sheet accounts have a healthy balance. Contra accounts can also be used to reflect negative balances in certain accounts. The purpose of the Accumulated Depreciation account is to track the reduction in the value of the asset while preserving the historical cost of the asset. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping.

- Contra accounts are an essential part of accounting that are often misunderstood or overlooked.

- Contra accounts provide a transparent and accurate representation of a company’s financial position, ensuring that financial statements reflect the true financial health of the business.

- Other examples include (1) the allowance for doubtful accounts, (2) discount on bonds payable, (3) sales returns and allowances, and (4) sales discounts.

Prepare Financial StatementsThe closing entries will be a review as the process for closing does not change for a merchandising company. Closing entries also set the balances of all temporary accounts (revenues, expenses, dividends) to zero for the next period. A debit will be made to the bad debt expense for $4,000 to balance the journal the usual balance in a contra-revenue account is a: entry. Although the accounts receivable is not due in September, the company still has to report credit losses of $4,000 as bad debts expense in its income statement for the month. If accounts receivable is $40,000 and allowance for doubtful accounts is $4,000, the net book value reported on the balance sheet will be $36,000.

Instead, an adjusting journal entry is done to record the estimated amount of bad debt. Salaries Expense will usually be an operating expense (as opposed to a nonoperating expense). Depending on the function performed by the salaried employee, Salaries Expense could be classified as an administrative expense or as a selling expense. If the employee was part of the manufacturing process, the salary would end up being part of the cost of the products that were manufactured. Asset, liability, and most owner/stockholder equity accounts are referred to as permanent accounts (or real accounts).

Examples of contra assets include Accumulated Depreciation and Allowance for Doubtful Accounts. Unlike an asset which has a normal debit balance, a contra asset has a normal credit balance because it works opposite of the main account. By providing a clear and transparent mechanism to account for adjustments, these accounts enable stakeholders, including investors and creditors, to better understand a company’s financial health.